Every consumer has a claim to an account used for payments with basic functions (basic account), including homeless people, asylum seekers and people who are tolerated.

Off

The functions a basic account has to fulfil at least, are:

- Cash deposit and payout Debits

- Transfers and standing orders

- Cashless payments

If the bank offers to keep giro accounts online, this has to be possible for the basic account, too. The bank can demand reasonable account management fees.

In the past many consumers did not have access to an own giro account to handle their private payments cashless. With the commencement of the so-called Zahlungskontengesetz (ZKG) back in 2016, credit institutes were obligated to conclude a contract for a basic account with every entitled consumer.

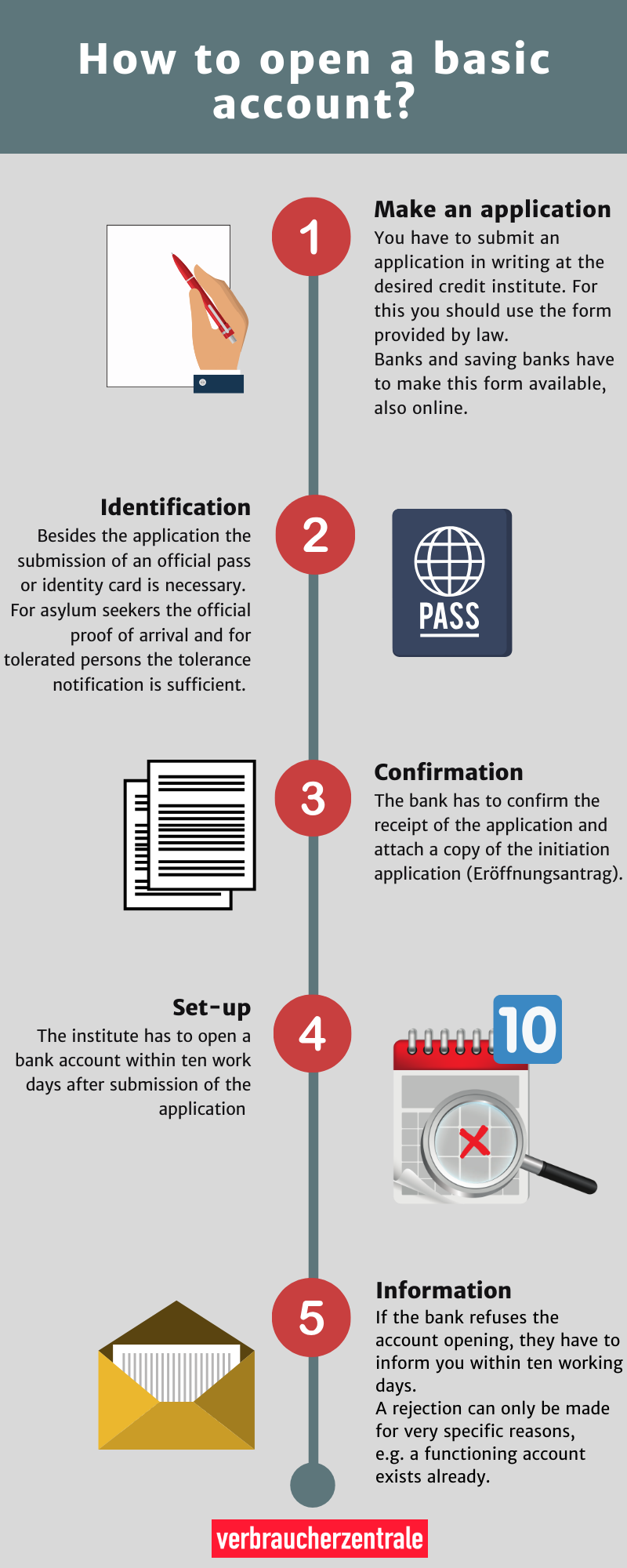

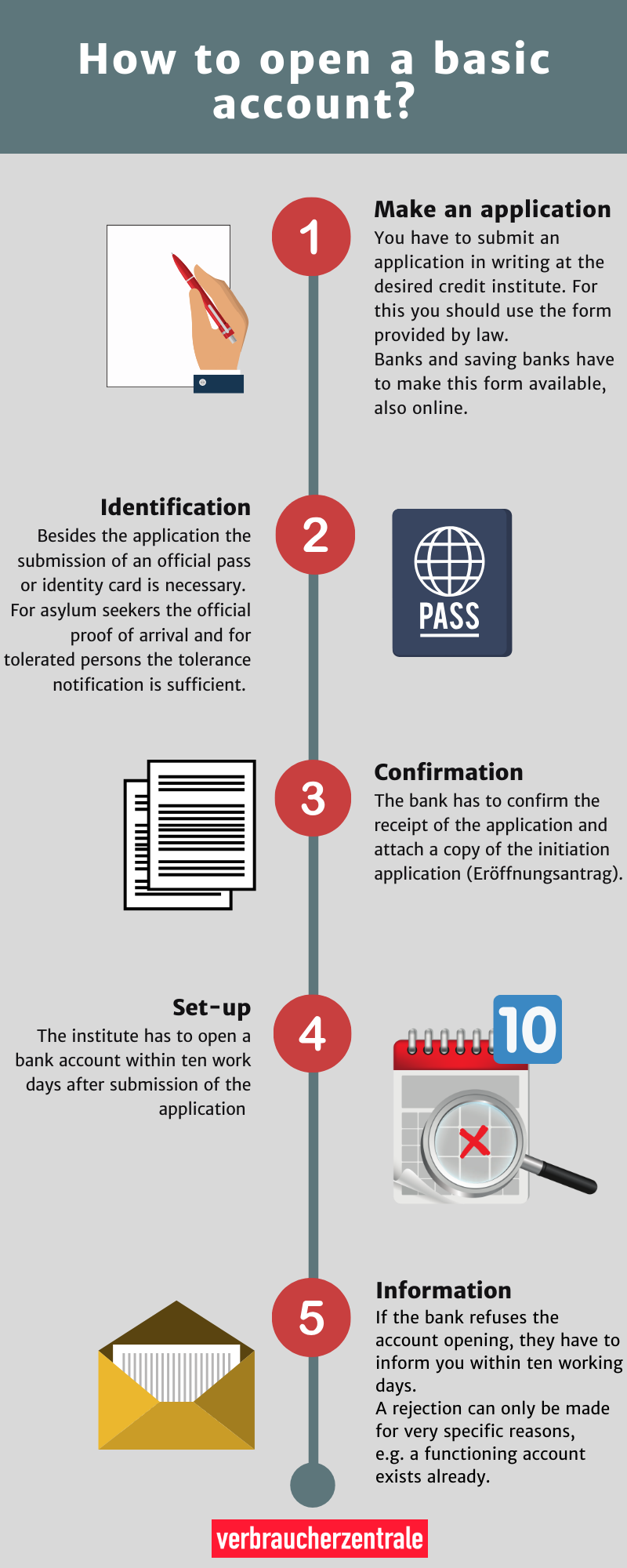

For organizations it is necessary to file an application to open a bank account. For this the form provided by law should be used, which the bank has to send the consumer free of charge, if he informs the bank that he wants to open an account. If the bank has a website, it has to make the form available there. Besides that you can find here the application provided by law for opening a bank account.

- If necessary you can demand directly that the basic account is arranged as a so-called Pfändungsschutzkonto (garnishment exemption account).

- The bank has to confirm the receipt of the application and attach a copy of the initiation application (Eröffnungsantrag).

- When the application is completely filled in, the bank has to make the establishment of a basic account possible within ten working days.

- If the bank refuses the account opening, they have to inform you within ten working days, too. A rejection can only be made for very specific reasons, e.g. it exists a functioning account. A rejection is not allowed because of a bad so-called Schufa (General Credit Protection Agency) or ongoing attachments.

- The bank has to explain a rejection in textual form and has to inform the consumer about his rights. The form provided by law for a review request to the Federal Financial Supervisory Authority (BaFin) as supervisory authority has to be attached.

- If the consumer requested a review of the rejection and the BaFin determines, that the rejection was unlawful, the BaFin orders the opening of the basic account.

- If the BaFin also rejects the opening of an account, you can file a suit against this decision at the district court (Landgericht).

- If the bank rejects your application, the consumer can file a suit directly instead of going to the BaFin for a review in the first place.